Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | |||

Filed by a Party other than the Registranto | |||

Check the appropriate box: | |||

o | Preliminary Proxy Statement | ||

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

ý | Definitive Proxy Statement | ||

o | Definitive Additional Materials | ||

o | Soliciting Material Pursuant to §240.14a-12 | ||

Hawaiian Electric Industries, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

HAWAIIAN ELECTRIC INDUSTRIES, INC. • PO BOX 730 • HONOLULU, HI 96808-0730

Constance H. Lau

President and

Chief Executive Officer

March 18, 200922, 2010

Dear Fellow Shareholder:

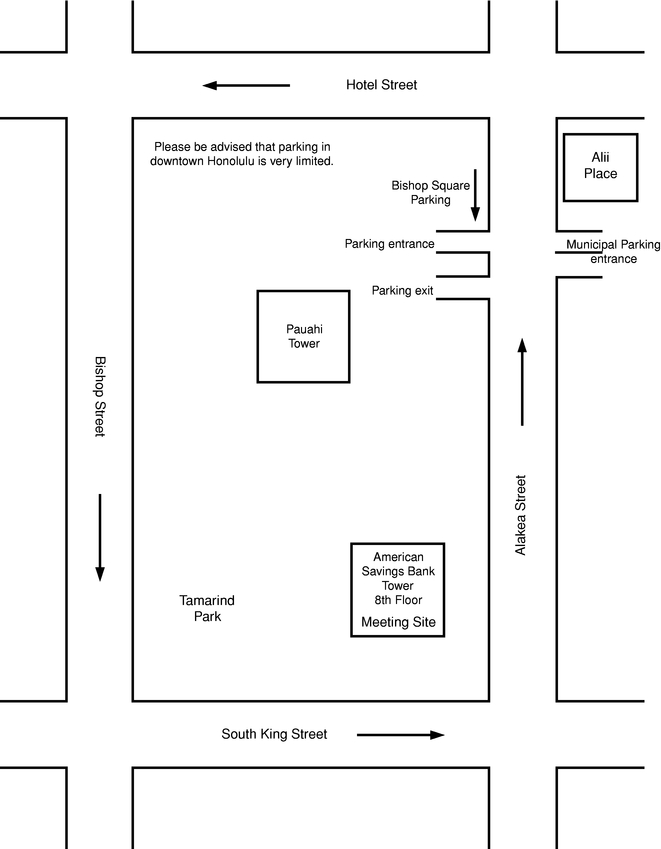

On behalf of the Board of Directors, it is my pleasure to invite you to attend the Annual Meeting of Shareholders of Hawaiian Electric Industries, Inc. (HEI). The meeting will be held on HEI's premises in Room 805 on the eighth floor of the American Savings Bank Tower, inlocated at 1001 Bishop Street, Honolulu, Hawaii, on May 5, 2009,11, 2010, at 9:30 a.m., local time. A map showing the location of the meeting site appears on page 7279 of the Proxy Statement.

The accompanying Notice of Annual Meeting of Shareholders and Proxy Statement describe the items of business to be conducted during the meeting. In addition, we will review significant events of 20082009 and their impact on you.you as a shareholder of HEI. HEI officers and Board members will be available before and after the meeting to talk with you and answer questions.

As a shareholder of HEI, it is important that your views be represented.Please help us obtain the quorum needed to conduct business at the meeting by promptly voting your shares.

The Board and management team of HEI would like to express their appreciation to you for your confidence and support. I look forward to seeing you at the Annual Meeting in Honolulu.

Sincerely,

![]()

Recycled |

Hawaiian Electric Industries, Inc. 900 Richards Street Honolulu, Hawaii 96813 |  | |

| Date and Time | Tuesday, May | |

Place | American Savings Bank Tower, 1001 Bishop Street, 8th floor, Room 805, Honolulu, Hawaii 96813. | |

Items of Business | 1. Elect | |

| 2. Ratify appointment of | ||

| 3. | ||

Annual Report | The | |

Proxy Voting | Shareholders of record may appoint proxies and vote their shares in one of four ways: | |

• Via the Internet | ||

• By telephone | ||

• By mail | ||

• In person | ||

Shareholders whose shares are held by a bank, broker or other financial intermediary | ||

Any proxy may be revoked in the manner described in the accompanying Proxy Statement. | ||

Attendance at Meeting | If your shares are registered in street name, please bring a letter from your bank or broker or provide other evidence of your beneficial ownership if you plan to attend the Annual Meeting. | |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders Held on May | The |

| By Order of the HEI Board of Directors. | ||||

|

| |||

| | Page | ||||

|---|---|---|---|---|---|

About the Meeting | 1 | ||||

Who can attend the meeting? | 1 | ||||

What are shareholders being asked to vote on? | 1 | ||||

Voting Procedures | 1 | ||||

| 1 | ||||

Who is eligible to vote? | 2 | ||||

How many shares are outstanding and entitled to vote? | 2 | ||||

What constitutes a quorum? | 2 | ||||

How do shareholders vote? | 2 | ||||

How do shareholders vote if their shares are held in street name? | 3 | ||||

How do shareholders vote if their shares are held in the Dividend Reinvestment and Stock Purchase Plan, | 3 | ||||

Can shareholders change their vote? | 3 | ||||

How many votes are required? | 3 | ||||

Who will count the votes and are the votes confidential? | 4 | ||||

Could other matters be decided at the Annual Meeting? | 4 | ||||

What happens if the Annual Meeting is postponed or adjourned? | 4 | ||||

Proposals You May Vote On | 4 | ||||

Election of Class | 4 | ||||

Ratification of appointment of Independent Registered Public Accounting Firm | |||||

Approval | 5 | ||||

Equity compensation plan information | 15 | ||||

Nominees for Class | |||||

| |||||

Continuing Class III directors whose terms expire at the 2011 Annual Meeting | |||||

Continuing Class I directors whose terms expire at the 2012 Annual Meeting | 20 | ||||

Corporate Governance | |||||

What are HEI's governance policies and guidelines? | |||||

What is the Board's leadership structure? | 22 | ||||

What is the Board's role in risk oversight? | 23 | ||||

How does the Board select nominees for the Board? | |||||

Does the Board consider diversity in identifying nominees for the Board? | 25 | ||||

How can shareholders communicate with the directors? | |||||

| |||||

Who are the independent directors of the Board? | |||||

| |||||

Board of Directors | |||||

How often did the Board of Directors meet in | |||||

Did all directors attend last year's Annual Meeting? | |||||

Committees of the Board | |||||

What committees has the Board established and how often did they meet? | |||||

What are the primary functions of each of the four committees? | |||||

Compensation Committee Report | |||||

Compensation Discussion and Analysis | |||||

Who were the named executive officers for HEI in | |||||

Summary of Results | |||||

Executive Summary | |||||

Compensation Process | |||||

Who is responsible for determining appropriate executive compensation? | |||||

Can the Compensation Committee modify or terminate executive compensation programs? | |||||

| |||||

| |||||

| Page | |||||

|---|---|---|---|---|---|

What is the role of executive officers in determining named executive officer compensation? | |||||

How do HEI's compensation policies and practices relate to HEI's risk management? | 35 | ||||

Compensation Program | |||||

What are the objectives of HEI's executive compensation programs? | |||||

What is each element of executive compensation? | |||||

Why does HEI choose to pay each element? | |||||

How does HEI determine the amount for each element? | |||||

How does each element fit into HEI's overall compensation objectives? | |||||

Compensation Elements | |||||

What are the base salaries of the named executive officers? | |||||

What was HEI's | |||||

| |||||

What was HEI's | |||||

| |||||

What is HEI's 2008-2010 long-term incentive plan? | |||||

What is HEI's 2009-2011 long-term incentive plan? | |||||

How does HEI award stock | |||||

What retirement benefits do named executive officers have? | |||||

| |||||

Can named executive officers participate in nonqualified deferred compensation plans? | |||||

Do named executive officers have executive death benefits? | 51 | ||||

Do named executive officers have change-in-control agreements? | |||||

What | |||||

Executive Compensation | |||||

Summary Compensation Table | |||||

Grants of Plan-Based Awards | |||||

Outstanding Equity Awards at Fiscal Year-End | |||||

Option Exercises and Stock Vested | |||||

Pension Benefits | |||||

Nonqualified Deferred Compensation | |||||

Potential Payments Upon Termination or Change in Control | |||||

Director Compensation | |||||

How is director compensation determined? | |||||

Director Compensation Table | |||||

Stock Ownership Information | |||||

| |||||

| |||||

Does HEI have stock ownership and retention guidelines for directors and officers? | |||||

Section 16(a) Beneficial Ownership Reporting Compliance | |||||

Other Relationships and Related Person Transactions | |||||

Does HEI have a written related person transaction policy? | |||||

Are there any family relationships between any HEI executive officer, director and nominee for director? | |||||

Are there any arrangements or understandings between any HEI director or director nominee and another person pursuant to which such director or director nominee was selected? | 73 | ||||

Are there any related person transactions with HEI or its subsidiaries? | |||||

Compensation Committee Interlocks and Insider Participation | |||||

Audit Committee Report | |||||

Other Information | |||||

How are proxies solicited and what is the cost? | |||||

What is the deadline for submitting a proposal for next year's Annual Meeting? | |||||

How can business matters be brought before the Annual | |||||

How can shareholders | |||||

What provisions has HEI made for "householding"? | |||||

Map | |||||

Appendix A — | A-1 | ||||

Appendix B — | |||||

| |||||

HEI is soliciting proxies for the Annual Meeting of Shareholders scheduled for May 5, 2009,11, 2010, at 9:30 a.m., local time, at the American Savings Bank Tower, 1001 Bishop Street, 8th floor, Room 805, Honolulu, Hawaii. The mailing address of the principal executive offices of HEI is P. O.P.O. Box 730, Honolulu, Hawaii 96808-0730.

The approximate mailing date for this Proxy Statement, form of proxy and annual and summary reportsAnnual Report to shareholders for the fiscal year ended December 31, 2008,Shareholders is March 18, 2009.22, 2010. The annual report and summary report are2009 Annual Report to Shareholders accompanying this Proxy Statement is not considered proxy soliciting materials.material.

Attendance will be limited to:

If you own shares of HEI Common Stock in the name of a bank, brokerage firm or other holder of record, you must show proof of ownership. This may be in the form of a letter from the holder of record or a recent statement from the bank or broker showing ownership of HEI Common Stock.

Any person claiming to be an authorized representative of a shareholder must produce written evidence of the authorization.

What are shareholders being asked to vote on?

Information about the Notice of Internet Availability of Proxy MaterialsElectronic access to proxy materials

This year, instead of mailing a printed copy of ourHEI provides shareholders the option to access its proxy materials to each shareholder of record, HEI has decided to provide access to these materials in a fast and efficient manner via the Internet to certain shareholders.Internet. In keeping with our efforts to conserve natural resources, this method of delivery will reducereduces the amount of paper necessary to produce these materials as well as reduceand reduces the costs associated with the printing and mailing of these materials to shareholders. On March 18, 2009,22, 2010, a Notice of Internet Availability of Proxy Materials ("Notice")(Notice) will be mailed to certain shareholders and our proxy materials will be posted on the website referenced in the Notice (www.ViewMaterial.com/HEI). As more fully described in the Notice, these shareholders may choose to access our proxy materials on the website referred to in the Notice or may request to receive a printed set of our proxy materials. InThe Notice and website will provide information

addition, the Notice and website will provide information regarding how you mayto request to receive proxy materials in printed form by mail or electronically by e-mail on an ongoing basis.

If you currently receive our proxy materials in printed form and would like to receive them electronically in the future, please so indicate on the enclosed proxy, if voting by mail, or by following the instructions provided when using the telephone or Internet voting options described under "How do shareholders vote?" below.

Only shareholderspersons who own shares of record atHEI Common Stock as of the close of business on February 25, 2009March 3, 2010 (the proxy record date) are entitled to vote.

How many shares are outstanding and entitled to vote?

On February 25, 2009, 90,611,290March 3, 2010, 92,658,123 shares of HEI Common Stock were outstanding. Each shareholder is entitled to one vote for each share held. Under the Bylaws of HEI, shareholders do not have cumulative voting rights in the election of directors.

A quorum is needed to conduct business at the Annual Meeting. A majority of the shares of HEI Common Stock outstanding on March 3, 2010 and entitled to vote, and present in person or by proxy at the meetingAnnual Meeting, constitutes a quorum. Abstentions and broker nonvotesvotes of uninstructed shares on routine matters (such as ratification of the appointment of the independent registered public accounting firm) will be counted in the number of shares present in person or by proxy for purposes of determining a quorum. A broker nonvote occurs when a broker does not have discretionary voting power to vote on a specific matter (such as nonroutine proposals) and has not received voting instructions fromquorum established for one purpose will apply for all purposes at the beneficial owner.Annual Meeting.

Whether or not you plan to attend the Annual Meeting, please take the time to vote. You may vote via the Internet, by touchtone telephone or by mail.mail before the Annual Meeting, or in person at the Annual Meeting. The Internet and telephone procedures are designed to authenticate your vote and confirm that your voting instructions are followed. If you vote via the Internet or by telephone, follow the instructions on the Notice or card you received by mail. Additionally, ifIf you vote by telephone, you will receive additional recorded instructions, orand if you vote via the Internet, you will receive additional instructions at the Internet website. You will need to have the control number on your Notice or proxy/voting instruction card, as applicable, available.

Shareholders who vote via the Internet or by telephone should not mail the proxy/voting instruction card.

on the enclosed proxy vote your shares at the meeting, cross out all three names and insert the name of another person to vote your shares at the meeting.

How do shareholders vote if their shares are held in street name?

If your shares are held in "street name" (that is, through a broker, trustee or other holder of record), you will receive a voting instruction card or other information from your broker or other holder of record seeking instruction as to how your shares should be voted. If no instructions are given,you do not provide such instruction, your broker or nominee may vote your shares at its discretion on your behalf on routine matters, (such as the election of directors, thebut not on nonroutine matters. The ratification of the appointment of HEI's independent registered public accounting firm is considered a routine matter. The election of directors and the amending and restatingapproval of the Restated Articles of Incorporation) under New York Stock Exchange rules.2010 Equity and Incentive Plan are considered nonroutine matters.

You may not vote shares held in "street name" at the Annual Meeting unless you obtain a legal proxy from your broker or holder of record.

How do shareholders vote if their shares are held in the Dividend Reinvestment and Stock Purchase Plan, or the HEI Retirement Savings Plan or the American Savings Bank 401(k) Plan?

If you own shares held in the Dividend Reinvestment and Stock Purchase Plan, or the HEI Retirement Savings Plan (including shares previously received under the Tax Reduction Act Stock Ownership Plan), or the American Savings Bank 401(k) Plan, the respective plan trustees will vote thethose shares of stock held in these Plans according to your directions. For both the Dividend Reinvestment and Stock Purchase Plan and the HEI Retirement Savings Plan,all of these plans, the respective trustees will vote all the shares of HEI Common Stock for which they receive no voting instructions in the same proportion as they vote shares for which they receive instruction.

Can shareholders change their vote?

If you execute and return a proxy,vote by any of the methods described above, you may revoke ityour proxy or vote at any time before the Annual Meeting in one of three ways:

If a quorum is present at the Annual Meeting, then:

such ratification. Abstentions and broker nonvotes will count in establishing a quorum, but will not otherwise affect the outcome of this matter.

Who will count the votes and are the votes confidential?

Corporate Election Services will act as tabulator for broker and bank proxies as well as thefor proxies of the other shareholders of record. Your identity and vote will not be disclosed to persons other than those acting as tabulators except as follows:except:

Could other matters be decided at the Annual Meeting?

HEI knows of no business to be presented at the 20092010 Annual Meeting other than the items set forth in this proxy statement.Proxy Statement. If other business is properly brought before the Annual Meeting, or any adjournment or postponement thereof, the persons named on the enclosed proxy will vote your stock in accordance with their best judgment, unless authority to do so is withheld by you in your proxy.

What happens if the Annual Meeting is postponed or adjourned?

If the Annual Meeting is postponed or adjourned, your proxy will still be good and may be voted at the postponed or adjourned meeting. You will still be able to change or revoke your proxy until it is voted at the Annual Meeting.

1. Election of Class III Directors

The Board of Directors currently consists of 12 directors divided into three classes with staggered terms so that one classterms. Ms. Plotts, a Class II director, will retire from the Board when her current term as a Class II director ends at the Annual Meeting. Concurrently with the retirement of directors must be electedMs. Plotts from the Board at eachthe Annual Meeting.Meeting, the authorized size of the Board will decrease from 12 to 11 directors.

The fourBoard proposes three Class III nominees being proposed for election at thisthe Annual Meeting are:Meeting:

Each nominee is currently a member of the Board and has consented to serve for the new term expiring at the 20122013 Annual Meeting.Meeting if elected. If a nominee is unable to stand for election, the proxy holders listed in the proxy may vote in their discretion for a suitable substitute.

YOUR BOARD RECOMMENDS THAT YOU VOTE FOR EACH OF THE NOMINEES FOR CLASS I DIRECTOR.II DIRECTOR LISTED ABOVE.

Detailed information onInformation regarding the business experience and certain other directorships for each Class III nominee and on the Class III and III directorsdirector is provided on pages 8-10.16-21 together with a description of the

experience, qualifications, attributes and skills that led to the Board's conclusion that each of the nominees and directors should serve on the Board at the time of this Proxy Statement, in light of HEI's current business and structure.

2. Ratification of appointment of Independent Registered Public Accounting Firm

KPMG LLP, an independent registered public accounting firm, has beenOn February 26, 2010, the auditor of HEI since 1981. The Audit Committee selected KPMGengaged PricewaterhouseCoopers LLP as HEI's new independent registered public accounting firm for 2009.2010, subject to shareholder ratification. The Board, upon the recommendation of its Audit Committee, recommends the ratification of KPMGthe appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of HEI for fiscal year

2009 2010 and thereafter until its successor is appointed. KPMG LLP was HEI's independent registered public accounting firm for 2009 and has been the auditor of HEI since 1981. Representatives of KPMG LLP and PricewaterhouseCoopers LLP will be present at the Annual Meeting and each will be given the opportunity to make a statement and to respond to appropriate questions.

On February 23, 2010, the Audit Committee voted to dismiss KPMG LLP as HEI's independent registered public accounting firm, effective as of February 24, 2010. The company informed KPMG LLP of the decision and dismissed KPMG LLP on February 24, 2010. KPMG LLP's reports on HEI's consolidated financial statements as of and for the fiscal years ended December 31, 2009 and 2008 contained no adverse opinion or disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles. The audit reports of KPMG LLP on the effectiveness of internal control over financial reporting as of December 31, 2009 and 2008 did not contain an adverse opinion or disclaimer of opinion, nor were they qualified as to uncertainty, audit scope or accounting principles. During the fiscal years ended December 31, 2009 and 2008 and through February 24, 2010, there were no disagreements with KPMG LLP on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of KPMG LLP, would have caused it to make reference to the subject matter of the disagreements in connection with its reports for such years. During the fiscal years ended December 31, 2009 and 2008 and through February 24, 2010, there were no reportable events as defined in Item 304(a)(1)(v) of the Securities and Exchange Commission's Regulation S-K.

During the fiscal years ended December 31, 2009 and 2008 and through February 26, 2010, the date of engagement of PricewaterhouseCoopers LLP, neither HEI nor any person on its behalf has consulted with PricewaterhouseCoopers LLP with respect to either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on HEI's consolidated financial statements, and no written report or oral advice was provided by PricewaterhouseCoopers LLP to HEI that PricewaterhouseCoopers LLP concluded was an important factor considered by HEI in reaching a decision as to the accounting, auditing, or financial reporting issue; or (ii) any matter that was the subject of either a disagreement as defined in Item 304(a)(1)(iv) of the Securities and Exchange Commission's Regulation S-K or a reportable event as described in Item 304(a)(1)(v) of the Securities and Exchange Commission's Regulation S-K.

YOUR BOARD AND THE AUDIT COMMITTEE RECOMMEND THAT YOU VOTE FOR THE RATIFICATION OF KPMGTHE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR HEI.HEI FOR 2010.

3. Approval of 2010 Equity and Incentive Plan

HEI's Compensation Committee believes that the use of long-term incentives that reward selected employees of HEI or its affiliates whose contributions are essential to amendthe growth and restatesuccess of HEI's business best strengthens the commitment of such persons to HEI Restated Articlesand its affiliates, motivates such persons to faithfully and diligently perform their responsibilities and attracts and retains competent and

Table of IncorporationContents

dedicated persons whose efforts will result in the long-term growth and profitability of HEI. To that end, on February 11, 2010, the Board adopted the Hawaiian Electric Industries, Inc. 2010 Equity and Incentive Plan (2010 Plan), subject to the approval of HEI's shareholders. The purpose of the 2010 Plan is to afford an incentive to regular full-time employees of HEI or any affiliate of HEI to continue as employees, to increase their efforts on behalf of HEI and to promote HEI's business, all in accordance with the Compensation Committee's philosophy set forth below. Subject to shareholder approval of the 2010 Plan, no new awards will be made under HEI's 1987 Stock Option and Incentive Plan, as amended from time to time (1987 Plan). The 1987 Plan will remain in effect with respect to awards previously made under such Plan. If shareholders do not approve the 2010 Plan, the 2010 Plan will have no effect and awards may continue to be granted under the 1987 Plan.

The 2010 Plan is being submitted to HEI's shareholders in order to ensure its compliance with Section 162(m) of the Internal Revenue Code (Section 162(m)) and the New York Stock Exchange (NYSE) listing standards concerning shareholder approval of equity compensation plans and the grant of incentive stock options. The NYSE listing standards provide that shareholders must be given the opportunity to vote on all equity compensation plans and material revisions thereto. The 2010 Plan is an equity compensation plan (i.e., a plan that provides for the delivery of HEI Common Stock to our employees as compensation for their services) and we are asking in this proposal for your approval of the 2010 Plan in compliance with the NYSE listing standards.

Section 162(m) denies a deduction by an employer for certain compensation in excess of $1,000,000 per year paid by a publicly held corporation to the following covered employees who are employed at the end of the corporation's taxable year: the Chief Executive Officer, the Chief Financial Officer and the three other most highly compensated executive officers (other than the Chief Executive Officer and the Chief Financial Officer) for whom compensation disclosure is required under the proxy rules. Certain compensation, including compensation based on the attainment of performance goals, is excluded from this deduction limit if certain requirements are met. Among the requirements for compensation to qualify for this exclusion is that the material terms pursuant to which the compensation is to be paid be disclosed to and approved by the shareholders in a separate vote prior to the payment of any such compensation, and that the plan be administered by "outside directors", as defined in Section 162(m). Accordingly, if the 2010 Plan is approved by shareholders and other conditions of Section 162(m) relating to the exclusion for performance-based compensation are satisfied, compensation paid to covered employees pursuant to the 2010 Plan will not be subject to the deduction limit of Section 162(m). We are asking in this proposal for your approval of the 2010 Plan and the performance goals that are applicable under the 2010 Plan where an award is intended to qualify as performance-based compensation under Section 162(m).

We are also seeking your approval so that we may use the 2010 Plan to grant incentive stock options (options that enjoy certain favorable tax treatment under Sections 421 and 422 of the Internal Revenue Code), if applicable.

The Board of Directors has approved, and recommends to shareholders that they approve, the Amended and Restated Articles of Incorporation of HEI in the form attached as Appendix B to this Proxy Statement. Thefollowing is a summary set forth below of the amendments that will be effected by approvalmaterial terms of this proposalthe 2010 Plan and is qualified in its entirety by reference to the full text of the Amended and Restated Articles of Incorporation,2010 Plan, which is incorporated herein by reference.attached as Appendix A to this Proxy Statement.

Purposes

HEI last restated its ArticlesThe purposes of Incorporation on December 16, 1987 (the "1987 Restated Articles"). Since that time, there have been three amendments to the 1987 Restated Articles recommended by the directors and approved by shareholders and one amendment to the 1987 Restated Articles that occurred by operation of law:2010 Plan are to:

(a) amended the first paragraph of Article Fourth to increase the amount of HEI Common Stock from 100,000,000 shares to 200,000,000 shares and (b) replaced the provisions of Section (b) of Article Sixth with a new provision recognizing the responsibility of the audit committee for the appointment, removal, compensation and oversight of HEI's independent registered public accounting firm.

The proposed Amended and Restated Articles of Incorporation, if approved by shareholders, will:

Administration of the 2010 Plan

The 2010 Plan will be included in amendedadministered by the Board or, if and restated articles of incorporation under Hawaii law, and thereby shorten and simplify HEI's articles of incorporation. These deletions are of (i) the preamble to the 1987 Restated Articles, (ii) information concerningextent the identityBoard does not administer the 2010 Plan, the Compensation Committee of the initial directors and officersBoard or a subcommittee of the corporation in Article Fifth and section (a) of Article Sixth of the 1987 Restated Articles, respectively, (iii) a provision in Article Fifth of the 1987 Restated Articles which permits a provisionCompensation Committee. Pursuant to be included in the HEI By-laws for filling temporary vacancies caused by the illness, absence from the Island of Oahu, or other disability of directors, (iv) information concerning the initial subscriber for HEI's shares that comprised Article Thirteenth of the 1987 Restated Articles and (v) the final paragraph of the 1987 Restated Articles relating to execution of the articles by the initial incorporators.

Change in Statutory Reference. As noted in the first bullet point above, the 1987 Restated Articles were amended in 1990 by the addition of a new Article Fourteenth, the first sentence of which provides:

The personal liability of directors of the corporation for monetary damages shall be eliminated to the fullest extent permissible under Hawaii law, including, without limitation, to the fullest extent permissible under Section 415-48.5 of the Hawaii Revised Statutes, as amended from time to time.

Since Article Thirteenth of the 1987 Restated Articles has been eliminated as unnecessary historical information, the provision added as Article Fourteenth in 1990 is numbered Article Thirteenth in the proposed Amended and Restated Articles of Incorporation. Article Thirteenth differs from former Article Fourteenth in the 1987 Restated Articles only in that the statutory reference in Article Thirteenth is changed from Section 415-48.5 of the Hawaii Revised Statutes to Section 414-222 of the Hawaii Revised Statutes. Section 415-48.5 was the provision of the Hawaii Business Corporation Act (Chapter 415 of the Hawaii Revised Statutes) in effect in 1990 that related to the ability of a corporation to eliminate or limit the liability of directors by a provision to that effect in its articles of incorporation, and Section 414-222 is the counterpart provision in the current Hawaii Business Corporation Act (Chapter 414 of the Hawaii Revised Statutes), which became effective in July of 2001.

Even without changing the statutory reference, Section 414-222 would determine the extent to which a director's liability has been eliminated by HEI, since Section 414-222 is the statutory provision that currently governs the extent to which a director's liability can be eliminated or limited under Hawaii law. Section 414-222 permits a corporation to eliminate the personal liability of a director in a provision such as Article Thirteenth except for (1) the amount of a financial benefit received by a director to which the director is not entitled, (2) an intentional infliction of harm on the corporation or its shareholders, (3) a violation of Section 414-223 (which relates to the liability of a director for an unlawful dividend or other distribution, such as an unlawful share repurchase) and (4) an intentional violation of criminal law.

Elimination of the Series A Junior Participating Preferred Stock. HEI and Continental Stock Transfer & Trust Company, as Rights Agent, entered into a Rights Agreement, dated October 28, 1997, which was subsequently amended on May 7, 2003 and October 26, 2004. At the time the Rights Agreement was entered into and in accordance with its provisions, the Board authorized a series of 500,000 shares of Preferred Stock designated as Series A Junior Participating Preferred Stock and filed the resolution establishing the terms of this seriesthe 2010 Plan and subject to any restrictions on the authority delegated to it by the Board, the administrator will have the power and authority, without limitation, to:

No

All decisions made by the administrator pursuant to the Rights Agreement and, with expirationprovisions of the Rights Agreement, none2010 Plan will be final, conclusive and binding on all persons, including HEI and the participants.

Eligibility

Awards may be granted to any regular full-time employee of HEI or any of its affiliates who has been selected as an eligible participant by the administrator. Incentive stock options will be granted only to employees (including officers and directors who are plannedalso employees) of HEI or any of its 50% or more owned subsidiaries.

Shares Reserved for Issuance

The maximum number of shares of HEI Common Stock reserved for issuance under the 2010 Plan will be 4,000,000 shares, subject to adjustment for certain transactions, provided that shares that are issued in connection with all awards other than options and share appreciation rights or awards whose vesting, exercisability or payment is subject to the attainment of performance goals will be counted against the 4,000,000 limit described above as four shares of HEI Common Stock for every share of HEI Common Stock that is issued in connection with such award. The shares may be authorized but unissued HEI Common Stock or shares that have been or may be reacquired by HEI in the open market, in private transactions or otherwise. If any shares subject to an award are forfeited, cancelled, exchanged or surrendered or if an award otherwise terminates or expires without a distribution of

shares to a participant, the shares with respect to such award will, to the extent of any such forfeiture, cancellation, exchange, surrender, termination or expiration, again be available for awards under the 2010 Plan. If any award (other than a share appreciation right) is settled in part or in full in cash, the shares settled in cash will again be available for issuance in connection with future awards granted under the 2010 Plan. Notwithstanding the foregoing, shares surrendered or withheld as payment of either the exercise price of an award granted under the 2010 Plan (including shares otherwise underlying an award of a share appreciation right that are retained by HEI to account for the grant price of such share appreciation right) and/or withholding taxes in respect of such an award will no longer be available for grant under the 2010 Plan. All shares may be made subject to awards of incentive stock options.

To the extent required to comply with the requirements of Section 162(m), the aggregate number of shares subject to awards (other than other cash-based awards) awarded to any one participant during any calendar year may not, subject to certain equitable adjustments as provided in the 2010 Plan, exceed 100,000 shares, and the maximum value of the aggregate payment that any participant may receive with respect to other cash-based awards in any calendar year is $2,000,000.

The closing price per share of HEI Common Stock on the New York Stock Exchange on March 3, 2010 was $20.66.

Types of Awards

The 2010 Plan provides for the grant of stock options (including incentive stock options), share appreciation rights, restricted shares, deferred shares, performance shares, other share-based awards and other cash-based awards.

Options. The grant of each option will be memorialized in an award agreement, containing such terms and conditions as the administrator will determine. The administrator will have sole and complete authority to determine the participants to whom options will be granted under the 2010 Plan, the number of shares to be issued. Becausesubject to options and the terms and conditions of options (including whether the option is an incentive stock option), provided that the exercise price of each option may not be less than 100% of the fair market value (as defined in the 2010 Plan) of the underlying HEI Common Stock on the date of grant. If a participant owns or is deemed to own (by reason of the attribution rules applicable under Section 424(d) of the Internal Revenue Code) more than 10% of the combined voting power of all classes of stock of HEI or of any of its subsidiaries and an incentive stock option is granted to such participant, the exercise price of such an incentive stock option (to the extent required at the time of grant by the Internal Revenue Code) will be no less than 110% of the fair market value of the HEI Common Stock on the date such incentive stock option is granted. The term of any option granted under the 2010 Plan may not exceed 10 years, provided, however, that if an employee owns or is deemed to own (by reason of the attribution rules of Section 424(d) of the Internal Revenue Code) more than 10% of the combined voting power of all classes of stock of HEI or of any of its subsidiaries and an incentive stock option is granted to such employee, the term of such incentive stock option (to the extent required by the Internal Revenue Code at the time of grant) will be no more than 5 years from the date of grant. Notwithstanding the foregoing, the administrator will have the authority to accelerate the exercisability of any outstanding option at such time and under such circumstances as the administrator, in its sole discretion, deems appropriate.

Options may be exercised in whole or in part by giving written notice of exercise to HEI specifying the number of shares to be purchased, accompanied by payment in full of the aggregate exercise price of the shares so purchased in cash or its equivalent. As determined by the administrator, in its sole discretion, payment for any options in whole or in part may also be made (i) by means of consideration received under any cashless exercise procedure approved by the administrator (including the withholding of shares otherwise issuable upon exercise), (ii) in the form of unrestricted shares already

resolution establishingowned by the participant subject to certain conditions, (iii) any other form of consideration approved by the administrator and permitted by applicable law or (iv) any combination of the foregoing. A participant will have no rights to dividends or any other rights of a shareholder with respect to the shares subject to an option until the participant has given written notice of exercise, paid in full for such shares and satisfied the requirements of the 2010 Plan, and the shares are delivered to the participant.

To the extent that the aggregate fair market value (as defined in the 2010 Plan) of shares of HEI Common Stock with respect to which incentive stock options granted to a participant under the 2010 Plan and all other option plans of HEI or of any subsidiary of HEI become exercisable for the first time by the participant during any calendar year exceeds $100,000 (as determined in accordance with Section 422(d) of the Internal Revenue Code), the portion of such incentive stock options in excess of $100,000 will be treated as a nonqualified stock option.

Share Appreciation Rights. Share appreciation rights may be granted either alone (Free Standing Rights) or in conjunction with all or part of any option granted under the 2010 Plan (Related Rights). Subject to Section 409A of the Internal Revenue Code, in the case of nonqualified stock options, Related Rights may be granted either at or after the time of the grant of such option. In the case of an incentive stock option, Related Rights may be granted only at the time of the grant of the incentive stock option. The administrator will determine the participants to whom, and the time or times at which, grants of share appreciation rights will be made, the number of shares to be awarded, the price per share and all other conditions of share appreciation rights. Share appreciation rights will contain such additional terms and conditions, not inconsistent with the terms of the Series A Junior Participating Preferred Stock is considered part of HEI's Articles of Incorporation, however, elimination of this series of preferred stock requires shareholder approval. By approving2010 Plan, as the proposed Amended and Restated Articles of Incorporation, which makeadministrator will deem desirable, as set forth in an award agreement. Notwithstanding the foregoing, no referenceRelated Right may be granted for more shares than are subject to the Seriesoption to which it relates and any share appreciation right must be granted with an exercise price not less than the fair market value of the underlying HEI Common Stock on the date of grant.

A Junior Participating Preferred Stock, shareholdersparticipant will have no rights to dividends or any other rights of a shareholder with respect to the shares subject to a share appreciation right until the participant has given written notice of its exercise, paid in full for such shares and satisfied the requirements of the 2010 Plan, and the shares are delivered to the participant.

Upon the exercise of a Free Standing Right, the participant will be approvingentitled to receive up to, but not more than, that number of shares equal in value to the eliminationexcess of the Seriesfair market value as of the date of exercise over the price per share specified in the Free Standing Right multiplied by the number of shares in respect of which the Free Standing Right is being exercised.

Share appreciation rights that are Related Rights will be exercisable only at such time or times and to the extent that the options to which they relate are exercisable. A Junior PreferredRelated Right granted in connection with an incentive stock option will be exercisable only if and when the fair market value (as defined in the 2010 Plan) of shares of the HEI Common Stock effectivesubject to the incentive stock option exceeds the exercise price of such option. A Related Right may be exercised by a participant by surrendering the applicable portion of the related option, upon filingwhich the Amendedparticipant will be entitled to receive up to, but not more than, that number of shares equal in value to the excess of the fair market value as of the date of exercise over the exercise price specified in the related option multiplied by the number of shares in respect of which the Related Right is being exercised. Options which have been so surrendered, in whole or in part, will no longer be exercisable to the extent the Related Rights have been so exercised.

The administrator may determine to settle the exercise of a share appreciation right in cash in lieu of shares (or in any combination of shares and Restated Articlescash). The term of Incorporationeach Related Right will be the term of the option to which it relates, and no share appreciation right will be exercisable more than 10 years after the date such right is granted.

Restricted Shares, Deferred Shares and Performance Shares. The grant of each award of restricted shares, deferred shares and performance shares will be memorialized in an award agreement, containing such terms and conditions as the administrator will determine. The administrator will have sole and complete authority to determine the participants to whom awards of restricted shares, deferred shares and performance shares will be granted under the 2010 Plan, the number of shares to be subject to the awards and the terms and conditions of the awards, including whether the vesting of such an award will be restricted by time or subject to the attainment of one or more performance goals (as described below). The restricted shares, deferred shares and performance shares will be subject to restrictions and conditions pursuant to the 2010 Plan and as determined by the administrator at the time of grant or, subject to Section 409A of the Internal Revenue Code, at a later time. The administrator may, in its sole discretion, provide for the lapse of restrictions in installments and may accelerate or waive such restrictions in whole or in part based on such factors and such circumstances as the administrator may determine, in its sole discretion, including, but not limited to, the attainment of certain performance related goals; provided, however, that this sentence will not apply to any award which is intended to qualify as "performance-based compensation" under Section 162(m). Except as provided in the applicable award agreement, the participant will generally have the rights of a shareholder of HEI with respect to restricted shares or performance shares during the restricted period. The participant will generally not have the rights of a shareholder with respect to shares subject to deferred shares during the restricted period; provided, however, that, subject to Section 409A of the Internal Revenue Code, an amount equal to dividends declared during the restricted period with respect to the number of shares covered by deferred shares will, unless otherwise set forth in the applicable award agreement, be paid to the participant at the same time as dividends are paid to HEI's shareholders generally, provided that the participant is then providing services to HEI or any affiliate of HEI.

Other Share-Based or Cash-Based Awards. The administrator is authorized to grant awards to participants in the form of other share-based awards or other cash-based awards, as deemed by the administrator to be consistent with the Hawaii Departmentpurposes of Commercethe 2010 Plan and Consumer Affairs.as evidenced by an award agreement. The administrator will determine the terms and conditions of such awards, consistent with the terms of the 2010 Plan, at the date of grant or thereafter, including any performance goals and performance periods.

Performance Goals

Under the 2010 Plan, the administrator has the authority to determine that vesting or payment of an award will be subject to the attainment of one or more performance goals. The performance goals may include any combination of, or a specified increase or decrease of, one or more of the following over a specified period:

Where applicable, the performance goals may be expressed in terms of attaining a specified level of the particular criteria or the attainment of a percentage increase or decrease in the particular criteria, and may be applied to one or more of HEI or its affiliates, or a division or strategic business unit of HEI, or may be applied to the performance of HEI relative to a market index, a group of other companies or a combination thereof, all as determined by the administrator. The performance goals may include a threshold level of performance below which no payment will be made (or no vesting will occur), levels of performance at which specified payments will be made (or specified vesting will occur), and a maximum level of performance above which no additional payment will be made (or at which full vesting will occur). Each of the foregoing performance goals will be determined in accordance with generally accepted accounting principles and will be subject to certification by the administrator, provided that the administrator will have the authority to make equitable adjustments to the performance goals in recognition of unusual or nonrecurring events affecting HEI or any of its affiliates or the financial statements of HEI or any of its affiliates, in response to changes in applicable laws or regulations, or to account for items of gain, loss or expense determined to be extraordinary or unusual in nature or infrequent in occurrence or related to the disposal of a segment of a business or related to a change in accounting principles, in any case to the extent such adjustment does not cause a loss of deduction under Section 162(m).

Termination of Employment

Unless the applicable award agreement provides otherwise, in the event that the employment of a participant with HEI or any of its affiliates terminates for any reason other than cause, retirement, disability (each such term as defined in the 2010 Plan) or death, the participant's options and share appreciation rights:

The one-year period described above will be extended to three years after the date of such termination in the event of the participant's death during such one-year period.

Unless the applicable award agreement provides otherwise, in the event that the employment of a participant with HEI and all of its affiliates terminates on account of retirement, disability or death, the participant's options and share appreciation rights, to the extent that they were exercisable at the time of such termination, will become fully vested and will remain exercisable until the date that is three years after such termination, on which date they will expire. In the event of the termination of a

participant's employment for cause, all outstanding options and share appreciation rights granted to such participant will expire at the commencement of business on the date of such termination.

In the event of the termination of employment with HEI and all of its affiliates of a participant who has been granted one or more Related Rights, such rights will be exercisable at such time or times and subject to such terms and conditions as set forth in the related options.

The rights of participants granted restricted shares, deferred shares or performance shares upon termination of employment with HEI or any affiliate thereof during the restricted period will be set forth in the applicable award agreement.

Notwithstanding the foregoing, no option or share appreciation right will be exercisable after the expiration of its term.

Effect of a Change in Control

Except as otherwise provided in an award agreement or in an individual agreement between a participant and HEI, in the event of a change in control of HEI (as defined in the 2010 Plan), the surviving entity or acquiring entity (or the surviving or acquiring entity's parent company) will assume all awards outstanding under the 2010 Plan or will substitute for them with similar awards. Any such assumed or substituted award will provide that, if the participant's employment with HEI or an affiliate of HEI (or any successor) is terminated within 24 months following the change in control by HEI or an affiliate without cause or by the participant with good reason (as defined in the 2010 Plan), the award will become fully vested and exercisable and all restrictions on such awards will immediately lapse (with all performance goals or other vesting criteria deemed achieved at 100% of target levels), and each such award that is an option or share appreciation right will remain exercisable for not less than one year following such termination of employment.

To the extent the surviving entity (or acquiring entity or parent company, as the case may be) refuses to assume or substitute for outstanding awards:

Transferability of Awards

Unless otherwise determined by the administrator or provided in an award agreement, awards will not be transferable by a participant except by will or the laws of descent and distribution and will be exercisable during the lifetime of a participant only by such participant or his guardian or legal representative.

Amendment or Termination of the 2010 Plan

The Board may amend, alter or terminate the 2010 Plan, or amend an award, at any time, but no amendment, alteration or termination may be made that would impair the rights of a participant under any award without such participant's consent. Shareholder approval is required for any amendment that would increase the total number of shares (unless pursuant to an equitable adjustment as set forth in

the 2010 Plan), materially increase plan benefits, materially alter eligibility provisions or extend the maximum option term under the plan, or as otherwise required by law or applicable rule.

In addition, the administrator may not reduce the exercise price of an outstanding option or share appreciation right by amending its terms or by canceling such award in exchange for cash or the grant of a new award without first obtaining approval from the shareholders of HEI.

Term of the 2010 Plan

No awards may be made after the ten-year anniversary of the date on which shareholders approve the 2010 Plan but awards made before such tenth anniversary may extend beyond the tenth anniversary date.

The benefits to be derived under the 2010 Plan by participants cannot be determined, since the ultimate value of awards under the 2010 Plan depends on several factors, including the market value of HEI Common Stock, and future grants under the 2010 Plan will be made at the sole discretion of the administrator, based on a variety of considerations.

Certain Federal Income Tax Consequences

The following discussion of certain relevant federal income tax effects applicable to stock options and share appreciation rights granted under the 2010 Plan is a summary only, and reference is made to the Internal Revenue Code and the applicable regulations and rulings thereunder for a complete statement of all relevant federal tax provisions.

Options

With respect to nonqualified stock options, the grantee will recognize no income upon grant of the option, and, upon exercise, will recognize ordinary income to the extent of the excess of the fair market value of the shares on the date of option exercise over the amount paid by the grantee for the shares. Upon a subsequent disposition of the shares received under the option, the grantee generally will recognize capital gain or loss to the extent of the difference between the fair market value of the shares at the time of exercise and the amount realized on the disposition.

In general, no taxable income is realized by a grantee upon the grant of an incentive stock option. If shares are issued to a grantee (option shares) pursuant to the exercise of an incentive stock option granted under the 2010 Plan and the grantee does not dispose of the option shares within the two-year period after the date of grant or within one year after the receipt of such option shares by the grantee (disqualifying disposition), then, generally (i) the grantee will not realize ordinary income upon exercise and (ii) upon sale of such option shares, any amount realized in excess of the exercise price paid for the option shares will be taxed to such grantee as capital gain (or loss). The amount by which the fair market value of the HEI Common Stock on the exercise date of an incentive stock option exceeds the purchase price generally will constitute an item which increases the grantee's "alternative minimum taxable income" (as defined in the Internal Revenue Code).

If option shares acquired upon the exercise of an incentive stock option are disposed of in a disqualifying disposition, the grantee generally would include in ordinary income in the year of disposition an amount equal to the excess of the fair market value of the option shares at the time of exercise (or, if less, the amount realized on the disposition of the option shares) over the exercise price paid for the option shares.

Subject to certain exceptions, an option generally will not be treated as an incentive stock option if it is exercised more than three months following termination of employment. If an incentive stock

option is exercised at a time when it no longer qualifies as an incentive stock option, such option will be treated as a nonqualified stock option as discussed above.

In general, HEI will receive an income tax deduction at the same time and in the same amount as the employee recognizes ordinary income.

Share Appreciation Rights

The recipient of a grant of share appreciation rights will not realize taxable income and HEI will not be entitled to a deduction with respect to such grant on the date of such grant. Upon the exercise of a share appreciation right, the recipient will realize ordinary income equal to the fair market value of any shares received at the time of exercise. In general, HEI will be entitled to a corresponding deduction, equal to the amount of income realized.

Section 409A of the Internal Revenue Code

The American Jobs Creation Act of 2004 added Section 409A to the Internal Revenue Code (Section 409A), which imposes restrictions on "nonqualified deferred compensation" (as defined in Section 409A). Section 409A generally applies to amounts deferred after December 31, 2004. Generally, options and share appreciation rights with an exercise price at least equal to the fair market value of the underlying stock on the date of grant and restricted stock will not be considered deferred compensation if such awards do not include any other feature providing for the deferral of compensation. Failure to follow the provisions of Section 409A can result in taxation to the grantee of a 20% additional income tax and interest on the taxable amount and, depending on the state, additional state taxes. It is intended that payments and benefits under the 2010 Plan comply with or be exempt from Section 409A. If taxes or penalties under Section 409A are imposed on a grantee in connection with the 2010 Plan, such grantee will be solely responsible and liable for the satisfaction of all such taxes and penalties, and neither HEI nor any affiliate will have any obligation to indemnify or otherwise hold the grantee (or any beneficiary) harmless from any or all of such taxes or penalties.

Under the NYSE listing standards, the 2010 Plan will be approved if a majority of the votes cast are in favor of such approval, so long as the total votes cast represent more than 50% of all shares entitled to vote. Abstentions will be considered votes cast and will have the same effect as voting against the proposal. Broker nonvotes will have no effect on the outcome of the vote on the 2010 Plan.

YOUR BOARD RECOMMENDS THAT YOU VOTE FOR APPROVAL OF THE AMENDED2010 EQUITY AND RESTATED ARTICLES OF INCORPORATION.INCENTIVE PLAN.

Nominees for Class I directors whose terms expire at the 2012 Annual Meeting

| ||

| ||

| ||

|

ContinuingEquity compensation plan information

Information as of December 31, 2009 about HEI Common Stock that may be issued upon the exercise of awards granted under all of the company's equity compensation plans was as follows:

Plan category | (a) Number of securities to be issued upon exercise of outstanding options, warrants and rights (1) | (b) Weighted-average exercise price of outstanding options, warrants and rights | (c) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (2) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Equity compensation plans approved by shareholders | 432,677 | $ | 19.73 | 4,099,071 | ||||||

Equity compensation plans not approved by shareholders | — | — | — | |||||||

Total | 432,677 | $ | 19.73 | 4,099,071 | ||||||

Nominees for Class II directors whose terms expire at the 20102013 Annual Meeting

| Thomas B. Fargo, age 61, director since 2005 Business experience and other public company and HEI affiliate directorships since 2005 • Operating Executive Board Member, J.F. Lehman & Company (private equity firm), since 2008 • Owner, Fargo Associates, LLC (defense and homeland/national security consultancy), since 2005 • Chief Executive Officer, Hawaii Superferry, Inc. (interisland ferry), 2008-2009 • President, Trex Enterprises Corporation (defense research and development firm), 2005-2008 • Commander, U.S. Pacific Command, 2002-2005 • Director since 2008 and Audit Committee Member, Northrop Grumman Corporation • Director, Hawaiian Holdings, Inc., 2005-2008 • Director since 2005 and Audit Committee Member, Hawaiian Electric Company, Inc. (HEI subsidiary) | |

Skills and qualifications for HEI Board service • Extensive knowledge of the U.S. military, a major customer of HEI's electric utility subsidiary. | ||

• Leadership, strategic planning and financial and nonfinancial risk assessment skills developed over 39 years of leading 9 organizations ranging in size from 130 to 300,000 people and managing budgets up to $8 billion. | ||

• Experience with corporate governance, including audit, compensation and governance committees, from service on several public and private company boards. |

| Kelvin H. Taketa, age 55, director since 1993 Nominating and Corporate Governance Committee Chair Business experience and other public company and HEI affiliate directorships since 2005 • President and Chief Executive Officer, Hawaii • Director, | |

| ||

| • Executive management experience with responsibility for overseeing more than $405 million in charitable assets as President and Chief Executive Officer of the Hawaii Community Foundation. | |

• Proficiency in risk assessment, strategic planning and organizational leadership as well as marketing and public relations obtained from his current position at the Hawaii Community Foundation | ||

• Knowledge of corporate and nonprofit governance issues gained from his prior service as a director for Grove Farm Company, Inc., |

| Jeffrey N. Watanabe Business experience and other public company and HEI affiliate directorships since 2005 • Managing Partner, Watanabe Ing & Komeiji LLP, • Director since 2003 and Compensation and Corporate Governance Committee Member, Alexander & Baldwin, Inc. • Director • Director, Hawaiian Electric Company, Inc. (HEI subsidiary), from 1999-2006 and since 2008 • Broad business, legal, corporate governance and leadership experience from serving as Managing Partner of the law firm he founded, advising clients on a variety of business and legal matters for 35 years and from serving on a dozen public and private company and nonprofit boards and committees, including his current service on the Compensation and Corporate Governance Committees for Alexander & Baldwin, Inc. | |

• Specific experience with strategic planning from providing strategic counsel to local business clients and prospective investors from the continental United States and the Asia Pacific region for 25 years of his law practice. | ||

• Experience in public utility regulation from practicing law before the Hawaii Public Utilities Commission, which regulates HEI's utility subsidiaries. |

Class II director whose term will expire at the 2010 Annual Meeting

| Diane J. Plotts, age 74, director since 1987 Audit Committee Chair and Compensation and Executive Committee Member Business experience and other public company and HEI affiliate directorships since 2005 • Independent business advisor since 2000 • Director since 1996 and Audit Committee Chair, American Savings Bank, F.S.B. • 35 years of executive leadership, financial oversight, risk management and strategic planning experience from serving as General Partner and Director of Hemmeter Investment Company. | |

• Bank and corporate governance experience from serving as a | ||

• Fluency in organizational governance matters and boardroom dynamics from serving on a variety of nonprofit boards, including the University of Hawaii |

Continuing Class III directors whose terms expire at the 2011 Annual Meeting

| Don E. Carroll Compensation Committee Member Business experience and other public company and HEI affiliate directorships since 2005 • Retired Chairman, • Director since 2004 and Audit Committee Member, American Savings Bank, F.S.B. (HEI subsidiary) • 38 years of executive and finance management experience as President and Vice President, Finance of | |

• Experience with financial institutions and executive compensation and compensation program oversight from | ||

• In-depth knowledge and familiarity with issues facing HEI and its banking subsidiary gained from 14 years of service as a director for HEI and 6 years of service as a director for American Savings Bank, F.S.B. |

| Richard W. Gushman, II, age 64, director since 2007 Nominating and Corporate Governance Committee Member Business experience and other public company and HEI affiliate directorships since 2005 • President and Owner, DGM Group (real estate development firm), since 1973 • Managing Partner, Summit Financial Resources (financial services company), since 1994 • Director since 2002 and Audit Committee Member, American Savings Bank, F.S.B. (HEI subsidiary) • Demonstrated business leadership and financial management skills gained from executive management, financial stewardship and corporate governance leadership roles as chief executive officer of DGM Group for 37 years and Managing Partner of Summit Financial Resources for 16 years. | |

• Extensive experience in governance, board leadership and financial oversight from serving on a variety of corporate, advisory and community organization boards and in financial stewardship roles, including his current service as a director of James Campbell Company LLC and as a member of the state of Hawaii Department of Hawaiian Home Lands and the Office of Hawaiian Affairs Advisory Boards. | ||

• Valuable entrepreneurial and hands-on perspective and experience from having grown the real estate development practice he started in 1973 into the DGM Group. |

| Victor H. Li, S.J.D., age 68, director since 1988 Compensation Committee Member Business experience and other public company and HEI affiliate directorships since 2005 • Co-Chairman, Asia Pacific Consulting Group (Pacific region trade consultancy), since 1992 • Director, American Savings Bank, F.S.B. (HEI subsidiary), since 2004 • Thoughtful leadership and consensus-building skills and marketing and strategic planning experience acquired through his current position for the last 18 years as Co-Chairman of the Asia Pacific Consulting Group, and his former position for 10 years as chief executive for the East-West Center. | |

• Long-term knowledge and understanding of HEI's operations and strategic goals after 20 years on the Board. | ||

• Prior energy and public company board experience from serving as a director at Grumman Corporation and AES China Generating Co. Ltd. |

| Barry K. Taniguchi, age 63, director since 2004 Audit Committee Member Business experience and other public company and HEI affiliate directorships since 2005 • President and Chief Executive Officer, KTA Super Stores (grocery store chain), since 1989 • President, K. Taniguchi Ltd. (real estate lessor), since 1989 • Director, American Savings Bank, F.S.B. (HEI subsidiary), since 2002 • Director since 2001 and Audit Committee Chair, Hawaiian Electric Company, Inc. (HEI subsidiary) • Director, Hawaii Electric Light Company, Inc. (HEI subsidiary), 1997-2009 • Director, Maui Electric Company, Limited (HEI subsidiary), 2006-2009 | |

Skills and qualifications for HEI Board service • Current knowledge of and experience with the business community on the island of Hawaii, which is served by one of HEI's utility subsidiaries, Hawaii Electric Light Company, Inc., from serving in his current chief executive officer positions for the last 23 years. | ||

• Accounting and auditing knowledge and experience gained from obtaining a public accounting certification and working as an auditor and as a controller. | ||

• Extensive board experience and leadership roles in community and civic organizations, including from his current service on the boards of Hawaii Employers Mutual Insurance Company and Hawaii Community Foundation and as Chair of the Hawaii Island Economic Development Board. |

Continuing Class I directors whose terms expire at the 2012 Annual Meeting

| Shirley J. Daniel, Ph.D., C.P.A., age 56, director since 2002 Audit Committee Member Business experience and other public company and HEI affiliate directorships since 2005 • Professor of Accountancy, Shidler College of Business, University of Hawaii at Manoa, since 1995 • Director, American Savings Bank, F.S.B. (HEI subsidiary), since 2004 • Current expertise in accounting, auditing and corporate governance from teaching courses on these subjects at the Shidler College of Business. | |

• Business and leadership experience from her current service as Director for the Pacific Asian Management Institute and Center for International Business Education and Research and from her prior service as Managing Director for the Pacific Asian Center for Entrepreneurship and E-Business. | ||

• Prior experience in accounting and auditing from being a licensed certified public accountant and from working as an auditor and audit manager with the international accounting firm Arthur Young & Company (currently Ernst & Young LLP). |

| Constance H. Lau, age 58, director 2001-2004 and since 2006 Executive Committee Member Current and prior positions with the company • President and Chief Executive Officer and Director, HEI, since 2006 • Chairman of the Board, Hawaiian Electric Company, Inc. (HEI subsidiary), since 2006 • Chairman of the Board and Chief Executive Officer, American Savings Bank, F.S.B. (HEI subsidiary), since 2008 • Chairman of the Board, President and Chief Executive Officer, American Savings Bank, F.S.B., | |

| • President and Chief Executive Officer and Director, • Senior Executive Vice President and Chief Operating Officer and Director, American Savings Bank, F.S.B., 1999-2001 | |

• Treasurer, HEI, 1989-1999 | ||

• Financial Vice President and Treasurer, HEI Power Corp. (former HEI subsidiary), 1997-1999 | ||

• Treasurer, Hawaiian Electric Company, Inc. | ||

• Assistant Corporate Counsel, Hawaiian Electric Company, Inc., | ||

Other public company directorships since 2005 • Director since 2004 and Audit Committee Member, Alexander & Baldwin, Inc. | ||

Skills and qualifications for HEI Board service • Intimate understanding of the | ||

• Familiarity with current management and corporate governance practices from her current service as a director and Audit Committee member for Alexander & Baldwin, Inc. and as a director of AEGIS Insurance Services, Inc. | ||

• Experience with financial oversight and expansive knowledge of the Hawaii business community and the local communities that compose the company's customer bases from serving as a director or investment committee chairperson for various local industry, business development and educational organizations. |

| A. Maurice Myers, age 69, director since 1991 Compensation Committee Member Business experience and other public company and HEI affiliate directorships since 2005 • Chief Executive Officer and Director, POS Hawaii LLC (provider of point-of-sale business systems for restaurants and retailers), since 2009 • Chief Executive Officer and Director, Wine Country Kitchens LLC (manufacturer of gourmet food products), since 2007 • Chairman, Chief Executive Officer and President, Waste Management, Inc. (waste and environmental services provider), 1999-2004 • Director, Hawaiian Electric Company, Inc. (HEI subsidiary), 2004-2006 and since 2009 • 20 years of public company executive and board leadership experience as Chairman, Chief Executive Officer and President | |

| Yellow Corporation, President of America West Airlines and Chief Executive Officer and President of | |

• Practiced skills in risk assessment, strategic planning, financial oversight, customer and public relations and marketing exercised in leading successful restructuring efforts at Waste Management, Yellow Corporation and America West Airlines. | ||

• Diverse business experience and public and private company board experience, including from his prior service as a director and Compensation Committee Chair for Tesoro Corporation and as a director for BIS Industries Limited and Cheap Tickets. |

| James K. Scott, Ed.D., age 58, director since Audit and Nominating and Corporate Governance Committee Member Business experience and other public company and HEI affiliate directorships since 2005 • President, Punahou School (K-12 independent school), since 1994 • Director, • Recognized leadership and executive management skills as President of • 25 years of experience developing and executing strategic plans as the chief executive at two independent schools, including overseeing fundraising programs and admissions/marketing functions. | |

• Governance and board leadership experience from his current positions as Chair of the Secondary School Admission Test Board, director and former Chair of the Hawaii |

What are HEI's governance policies and guidelines?

In 2008,2009, the Board and management continued to review and monitor corporate governance trends and best practices to comply with the corporate governance requirements of the New York Stock Exchange, Listed Company Manual andregulations of the Securities and Exchange Commission regulations.and rules and regulations of the Board of Governors of the Federal Reserve, Federal Deposit Insurance Corporation and Office of Thrift Supervision applicable to HEI as a bank holding company. As part of an annual review, the HEI Categorical Standards of Director Independence (see Appendix B), Corporate Governance Guidelines Revised Code of Conduct (which includes the code of ethics for the HEI Chief Executive Officer, Financial Vice President and Controller), and charters for the Audit, Compensation, Executive and Nominating and Corporate Governance Committees were reviewed and revised as deemed appropriate by the Board. Current copiesThese documents, and HEI's Corporate Code of these documents may be foundConduct, are available on HEI's website at www.hei.comwww.hei.com.

What is the Board's leadership structure?

Mr. Watanabe has served as the nonexecutive Chairman of the Board since 2006, upon the retirement of former HEI Chairman, President and Chief Executive Officer, Robert F. Clarke. Also since that time, Ms. Lau has served as HEI's President and Chief Executive Officer and has been the only employee director on the Board. Prior to Mr. Watanabe becoming Chairman, the Board had an independent lead director.

Mr. Watanabe has served on the Board since 1987, but has never been employed by HEI or any HEI subsidiary. The Board has determined that he is independent. Among the many skills and qualifications that Mr. Watanabe brings to the Board, the Board considered (i) his extensive experience in corporate and nonprofit governance from serving on other public company, private company and nonprofit boards; (ii) his reputation for effective consensus and relationship building and business and community leadership, including leadership of his former law firm, and (iii) his willingness and dedication to committing the hard work and time necessary to successfully lead the Board.

As HEI's Chairman, Mr. Watanabe's key responsibilities are to:

The Board's Corporate Governance Guidelines provide that if the Chairman and Chief Executive Officer positions are held by the same individual, or if the Board determines that the Chairman is not independent, the independent directors should designate an independent director to serve as Lead Director. If a Lead Director is designated, the Lead Director's responsibilities would be to: (i) preside at Board and shareholder meetings when the Chairman is not present, (ii) preside at executive sessions

of the independent directors, (iii) facilitate communication between the independent directors and the Chairman or the Board as a whole, (iv) call meetings of the nonmanagement or independent directors in printexecutive session, (v) participate in approving meeting agendas, schedules and materials for the Board, and (vi) perform other functions described in the Corporate Governance Guidelines or as determined by the Board from time to time.